A D V A N C E D M A T E R I A L S & P R O C E S S E S | J U L Y / A U G U S T 2 0 1 6

2 6

METALLURGY LANE

Metallurgy Lane, authored by ASM life member Charles R. Simcoe, is a continuing series dedicated to the early history of the U.S.

metals and materials industries along with key milestones and developments.

THE INTEGRATED STEEL INDUSTRY—PART II

INTEGRATION OF THE STEEL INDUSTRY CONTINUED

WITH THE RISE OF BETHLEHEM STEEL CORP.

B

ethlehem Steel Corp. debuted as

Bethlehem Iron Co. in 1860 with

blast furnaces and rolling mills

for wrought iron railroad rails. The com-

pany hired John Fritz fromCambria Iron

Co. in Johnstown, Pa., as general man-

ager. After making iron rails for several

years, Bethlehem contracted with Alex-

ander Holley to build one of the first

Bessemer plants to convert to steel.

They installed four Bessemer convert-

ers and new rolling mills for steel rails.

The plant went onstream in 1873 with

annual capacity of 35,000 tons and a

reputation as the finest plant in the U.S.

However, it was a small plant and

its eastern location was problematic as

rail use was moving west. Under Fritz’s

leadership, the company built facilities

for making large forgings and heavy

plate, including armor plate for the

Navy. Previously, these products were

imported from England and Germany

due to a lack of domesticmanufacturers.

BethlehemSteel was soon recognized as

a producer of ship propeller shafts, large

gun barrels, and heavy battleship armor

equal to any provided from overseas.

The principals put the company up

for sale after the turn of the 19th cen-

tury. Charles Schwab bought 160,000

shares—giving him controlling inter-

est—while he was still president of U.S.

Steel Corp. When he was forced out of

“The Corporation,” he turned his full

attention to developing Bethlehem

Steel from a minor steelmaker into a

competitor to his former company. The

sale included several shipyards that

became a large part of Bethlehem’s

future production and profits.

When World War I started in

1914, the federal government passed

a Neutrality Act to keep the U.S. from

becoming involved in the conflict. This

prevented trade in armaments with

England, France, and Russia. Schwab

ignored the act, as did many other com-

panies, and received orders for gun bar-

rels, armor plate, and ammunition from

all three allies. Bethlehem Steel opened

a munition plant to supply this overseas

trade and as the war continued over four

years, it became the largest manufactur-

ing plant in artillery shells in the world,

making 750,000 shells per month. In

addition, it produced 60% of all finished

guns built for the U.S. market.

GROWTH AND PROFITS

DURING WWI

The company shipped 6 million

tons of steel during the war period and

went from 15,000 to 94,000 employ-

ees. The shipyard received orders for

freighters and destroyers, significantly

adding to profits. Earnings in 1916 were

$62 million, with Schwab receiving

$2.4 million in dividends and new

stock worth $17 million. With these

wartime profits, Bethlehem purchased

the Pennsylvania Steel Co. for $32 mil-

lion. They acquired the Steelton plant

built by Edgar Thomson and Tom Scott

during the age of Bessemer Steel and

a newer deep-water plant at Sparrows

Point, Md. Bethlehem now had annual

capacity of 2.2 million tons, exceeding

all competitors except U.S. Steel. In the

last two years of the war, Bethlehem’s

earned income was $111 million.

ACQUISITIONS DURING

THE 1920s

Bethlehem used its wartime prof-

its to acquire other steel companies.

In 1922, the company purchased the

Lackawanna Steel Co. outside Buffalo,

N.Y., for $54 million—raising its annual

capacity to 5.5 million tons. A year later,

it bought the Midvale Steel Co. for $95

million, which included Cambria Steel

where John Fritz had invented the three-

high rolling mill and William Kelly had

worked on his air blowing process. Beth-

lehem renamed Cambria Steel the John-

stown Mill. The addition of both Midvale

and Johnstown increased Bethlehem’s

annual capacity to 10 million tons.

Integrating these various steel

operations to improve efficiency and

lower overhead cost proved to be a

greater challenge than expected. This

would require a major effort during the

following two decades, as Bethlehem

had acquired older plants in need of

significant maintenance and upgrad-

ing. As part of the work, the company

modernized and added capacity to the

Sparrows Point plant, which became

one of the largest in the country.

THE GREAT DEPRESSION

As industry collapsed during the

Great Depression, steel shipments

reached lows not seen during the previ-

ous 20 years. In 1932, Bethlehem oper-

ated at just 20% of capacity with a loss

of $19million. When the recovery started

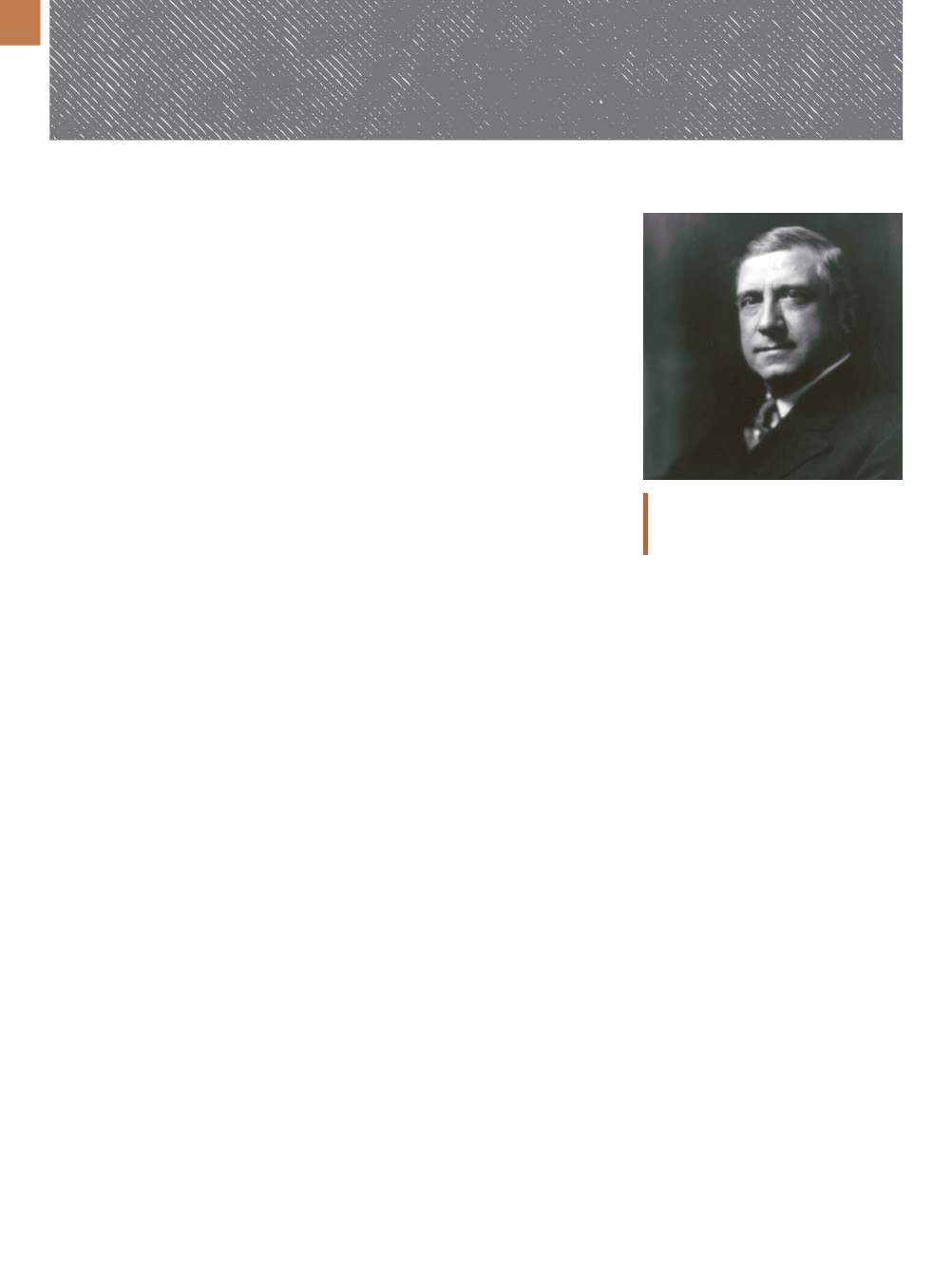

Charles M. Schwab, former president of

Carnegie Steel, was CEO of Bethlehem

Steel from 1904 to 1939. Circa 1918.