A D V A N C E D M A T E R I A L S & P R O C E S S E S | J U N E 2 0 1 6

6

MARKET SPOTLIGHT

FEEDBACK

GLOBAL GRAPHENE MARKET TO

REACH $2 BILLION BY 2035

By 2035, the world graphene market

is forecast to reach over $2 billion, sup-

ported by a significant wave of commer-

cialized products in applications such as

supercapacitors, high-frequency transis-

tors, sensors, and biomedical technol-

ogies. In the short term, the global mar-

ket is expected to grow more than 600%

through 2020 to $136 million, supported

by improved manufacturing technol-

ogies and falling prices, as well as on-

going development of novel graphene-

enhanced products. These and other

trends are presented in

World Graphene,

a new study from The Freedonia Group,

Cleveland.

Graphene-based composites fea-

ture the most promising near-term com-

mercialization prospects of any market.

Thermal stability and impermeability

drive graphene use in food packaging,

piping, and protective apparel applica-

tions, while high mechanical strength

and light weight make the material desir-

able for composites used in motor vehi-

cles, aircraft, and military equipment. In

the energy storage sector, Li-Ion battery

HONORING SINGLE CRYSTAL

TURBINE BLADES

I am on the History & Heritage

Committee of ASME, and I enjoyed

the March “Metallurgy Lane” article

about Frank VerSnyder and his team

at Pratt &Whitney. I recently sent

this article to committee members to

support my nomination to have the

Pratt &Whitney Aircraft single crystal

turbine blade work become an ASME

Landmark. It is nice to have another

technical society (ASM) say that the

work was a breakthrough—thanks!

It is also interesting to see the

different attitudes of the OEMs toward

these single crystal blades. In the

early days at Pratt, the final research

and development work was aimed at

developing the technology to get it

out to vendors. Pratt did not want to

go into the casting business. In more

recent times, competitor Rolls-Royce

now has its own SX casting efforts and

considers this a key part of its manu-

facturing.

Lee Langston

ERRATA

An error appeared in the article “An

Overview of Popular Materials Testing

Systems,” April issue. Table 1 listed

values of 50 to 60 Hz for electrome-

chanical systems and a value of 50

Hz for servohydraulic systems. The

values should have read up to 1 Hz for

electromechanical systems and up to

100 Hz for servohydraulic systems.

We welcome all comments

and suggestions. Send letters to

frances.richards@asminternational.org.

producers use graphene materials to

improve energy density. Graphene is

also expected to find growing adoption

in supercapacitors, as these are increas-

ingly used in electrical grids and renew-

able energy systems.

The U.S. is forecast to remain the

leading market for graphene through

2035, bolstered by growing use in high-

performance composites and energy

storage devices, as well as rising research

and development spending in advanced

electronics fields such as optoelectron-

ics. The Asia/Pacific region will rank as

the top graphene consumer, driven by the

advanced electronics and energy storage

industries of Japan, China, and South Ko-

rea, according to analysts. Like the U.S.,

these countries will remain at the forefront

of graphene R&D, funding nanotechnology

projects to further explore the material’s

potential. Western Europe will also remain

an important regional market, as Germany,

the UK, France, and Spain help lead devel-

opment and commercialization initiatives,

particularly inadvancedenergy sectors.

For

more information, visit

freedoniagroup.com.

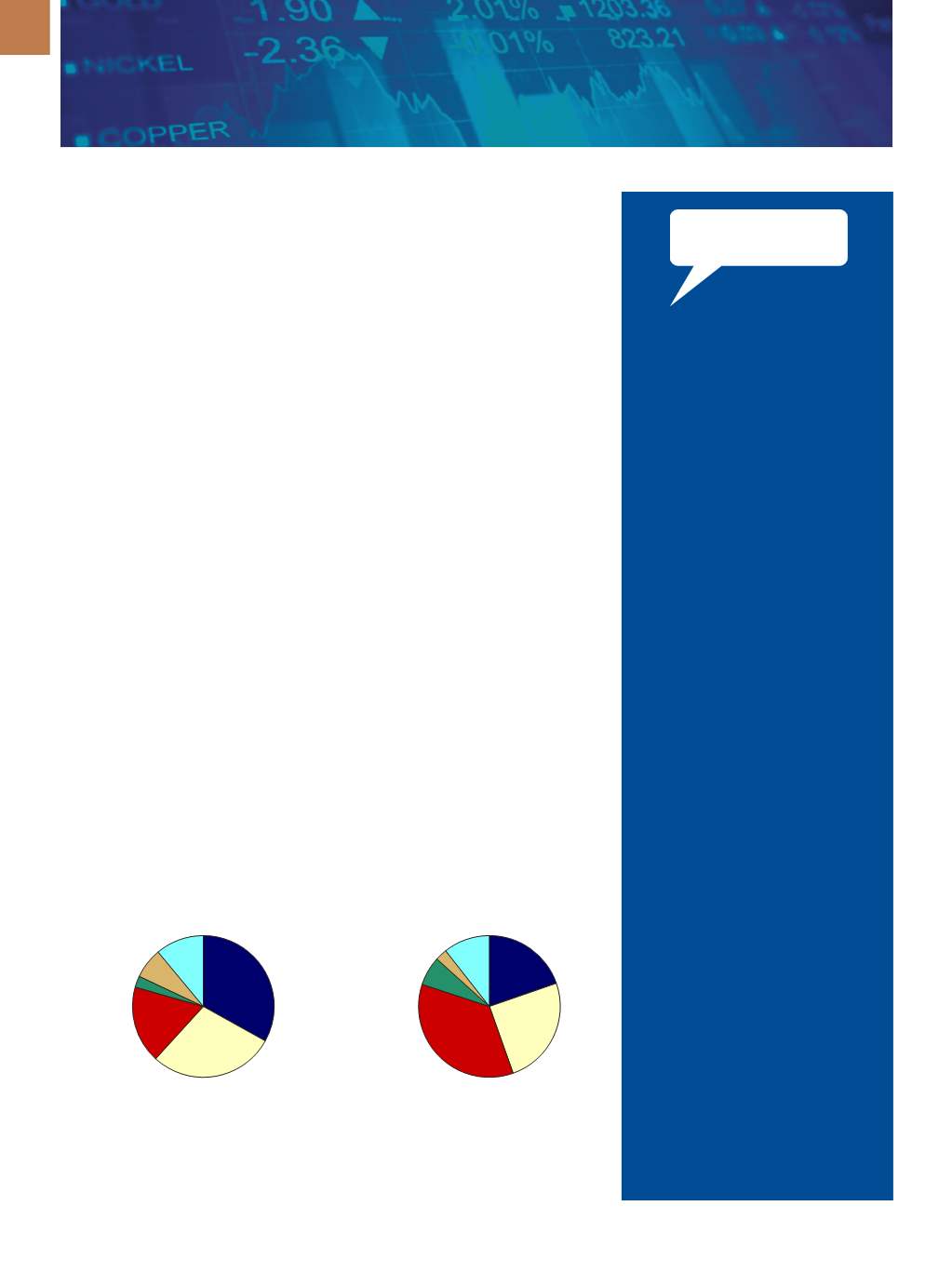

World Graphene Demand by Market, 2020 and 2035

Courtesy of The Freedonia Group

2020 – $136 Million

2035 – $2 Billion

Other 11%

Academic

research 7%

Biomedical 2.6%

Electronics 17.6%

Energy 28.7%

Composites 33.1%

Other 10.6%

Academic

research 2.7%

Biomedical 6.7%

Electronics 35.5%

Energy 24.9%

Composites 19.7%