T

he recently released Industry Market Barometer (IMB) from Thomas-

Net.com highlights several interesting trends, some positive and oth-

ers worrisome. Respondents include 1209 North American engineers and

purchasing agents, business owners and managers, and sales and market-

ing executives from manufacturers, distributors, and service companies.

The majority represent small companies (fewer than 100 employees and

less than $10 million in revenue), mirroring the makeup of the indus-

trial/manufacturing segment. Responses provide a unique opportunity to

peer into the strategies of these smaller companies.

In 2012, manufacturing accounted for roughly $1.9 trillion, or almost

12%, of U.S. GDP. More than half (55%) of the manufacturers surveyed grew

in 2012, and nearly two-thirds (63%) achieved growth in 2013. Even so, a

crack is slowly coming to the surface, say analysts. Research reveals that a

lack of fresh talent threatens the sector’s future vitality. The companies sur-

veyed represent today’s manufacturing

workforce, which is heavily populated

by employees who are 45 and

older. With Generation Y (18-

32 years old) expected to make

up 75% of the workforce by

2025, and older employees ex-

iting in droves, manufacturing’s

“biological clock” is ticking away,

according to report authors.

A closer look at the IMB findings re-

veals a jarring disconnect between the

growth of manufacturers and their lack of urgency when it comes to filling

their talent pipeline. For example, eight out of ten manufacturers report that

younger employees represent a very small fraction of their workforce—and

most don’t see this changing soon. Findings point to a need for a collective

“succession plan.” As a starting point, manufacturers need to address the per-

vasive myths about what a career in American manufacturing really means.

Three out of four IMB respondents (73%) say that negative perceptions about

the profession are deterring new generations from joining. Yet, the sameman-

ufacturers are vocal about the many rewards their industry offers and many

have developed creative partnerships with schools to engage their “best and

brightest,” pointing to educators as their ray of hope for the future. Yet the jury

is out on whether these efforts alone will be enough, say analysts.

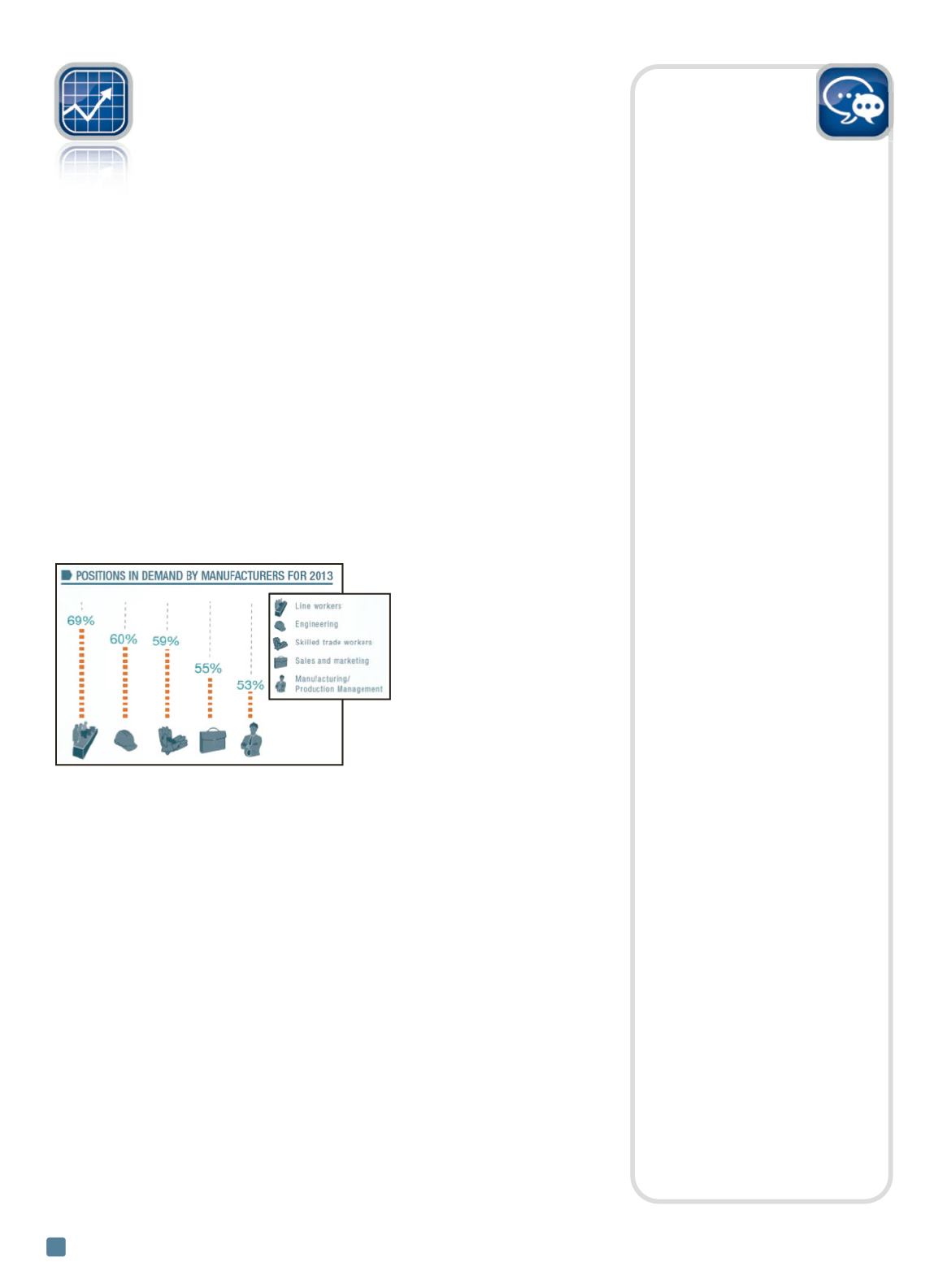

Of the survey respondents’ open job postings, 60% are looking for en-

gineers, 59% need skilled trade workers, 55% are hiring sales and market-

ing people, and 53% seek manufacturing/production management

personnel. However, a lack of basic skills in young workers is a drawback

to recruitment. More than 25% of companies say high schools should offer

more technical training to encourage students to pursue manufacturing

careers. Other suggestions include placing a stronger emphasis on STEM

courses, greater partnerships between manufacturers and colleges and

technical schools to inform students about opportunities, and parents en-

couraging their children to consider manufacturing careers.

For more

information, visit

www.thomasnet.com/imb.ADVANCED MATERIALS & PROCESSES •

JANUARY 2014

4

spot l ight

feedback

market

Manufacturing survey reveals

ticking biological clock

Put materials specification

where it belongs

If we go back a few decades, cars

were composite—mostly steel, some

rubber (tires). There were miscella-

neous other things too, such as glass,

rubber, and wiring insulation. Mankind

has developed a tendency to over-

specify iron and steel. Iron is probably

useful for engine blocks and steel may

be useful for frames, but it needs a

coating better than paint. Powder

coating may be sufficient, though I

think electroless nickel-plated, pow-

der-coated steel would be better, as

steel has little or no corrosion resist-

ance. Having a coating that can stand

up to most in-service abuse is useful,

although that coating must be on top

of a more resistant coating, which will

continue to protect the steel until the

first coating can be replaced after

wearing off.

In terms of the cosmetic exterior (the

body), steel has no business being

there, unless designers want to con-

sider stainless steel. (I thought not.)

Aluminum is useful too, but it is not a

durable substrate for paint.To use

steel or aluminum for an auto body is

to plan for a limited vehicle lifetime.

Composites should work better for oil

pans, valve covers, and the front cover

of the camshaft drive mechanism

because they provide corrosion resist-

ance plus sound deadening. Compos-

ites also have increased thermal

resistance, important to operating an

engine in cold climates. But people

need to get away from incorporating a

release compound into the bulk of

molding compounds used to make

body parts. Release compounds are

intended to separate the mold from

the part: They have no business being

a uniform component of the part.

I’ve seen many job postings where

part of the position involves specifying

materials. These jobs mostly call for

mechanical engineers, and materials

specification is almost always an “in-

significant” job function. A senior me-

chanical engineer might have 1000

hours of materials experience, yet I

have more than 35,000 hours. I am not

going to design cars, but I sure as

heck know more about materials than

a senior mechanical engineer. Get ma-

terials specification where it belongs,

not as a side task for an engineer who

doesn’t understand materials.

G.H., P.Eng.

We welcome all comments

and suggestions. Send letters to

frances.richards@asminternational.org.