A D V A N C E D M A T E R I A L S & P R O C E S S E S | J U L Y / A U G U S T 2 0 1 6

6

MARKET SPOTLIGHT

FEEDBACK

HIGH PERFORMANCE ALLOYS MARKET

TOREACH $11.33 BILLION BY 2024

The high performance alloys mar-

ket is expected to reach $11.33 billion

by 2024, according to a new report from

Grand View Research Inc., San Francisco.

The market is forecast to experience

significant growth due to titanium- and

aluminum-based high performance

alloys replacing steel and other alloys.

Platinum group metal alloy advance-

ments have increased their demand. For

example,

platinum-palladium-copper

alloys are used in wrought products,

significantly reducing costs. Further,

ruthenium-platinum-palladium alloys

are increasingly used in industrial appli-

cations due to high oxidation resistance

and superior strength. Key findings in

the report include:

•

Non-ferrous high performance

alloys are expected to be the fast-

est growing segment, forecast at

a CAGR of over 3% from 2016 to

2024.

•

The electrical and electronics seg-

ment was valued at over $6 billion

in 2015. High performance alloys

used in this industry are added

to conductive metals to optimize

efficiency.

BEWARE OF BERYLLIUM

I recently read the article “Beryllium

Optics Enable Advanced Space Tele-

scopes” from the September 2015 issue.

The article is excellent except for one

item: It does not mention the extreme

toxicity of beryllium or its horribly long

latency period of 20-40 years. I am one of

its victims. Of the various satellites I have

worked on, the Hubble Space Telescope

used virtually no berylliumdue to the

objections of Michael Krim, the engineer

responsible for its basic design.

Inmy opinion, beryllium should nev-

er be used again. Due its terrible effects,

I cannot walk 50 steps without sitting

down. I was never informed of its use or I

would have voicedmy opposition. In addi-

tion, the Occupational Safety and Health

Administration (OSHA) was never notified

of our usage for the satellites and they

cannot act if it is more than six months

since the cause of the complaint occurred.

At six months, there is no evidence at all.

X-rays are of no use. There is only a blood

test for “sensitization to beryllium.”

Other materials such as aluminum/

silicon carbide can take the place of beryl-

lium, so why use it at all? It is the latency

aspect that makes it so dangerous, as

well as the incredibly small amount of

dust that can be tolerated—less than

one milligramper cubic meter per day.

It makes arsenic seem like baby candy.

So the James Webb Space Telescope is

doomed from the start. One cannot ruin

the health of one’s fellowman and expect

no consequences.

Name withheld for privacy

We welcome all comments

and suggestions. Send letters to

frances.richards@asminternational.org.

•

The Asia Pacific region is expected

to exhibit the highest growth due

to increasing demand in emerging

economies and rapid industrializa-

tion in Indonesia, India, and China.

•

Europe accounted for a market

share of over 26% in 2015 and is

forecast to witness strong growth

over the next eight years due to

growing demand in the automotive

and aerospace industries.

•

Superalloys are expected to grow

by more than 4.5% from 2016 to

2024. Increased use in power plants,

chemical and petrochemical pro-

cessing, and the oil and gas industry

is expected to spur demand over the

next eight years.

For more information on “High

Performance Alloys Market Analysis by

Product (Non-Ferrous Alloys, Platinum

Group Metal Alloys, Refractory Metal

Alloys and Superalloys), by Application

(Aerospace, Automotive, Industrial Gas

Turbines, Industrial, Oil & Gas, Electron-

ic), by Material (Aluminum, Titanium,

Magnesium) and Segment Forecasts to

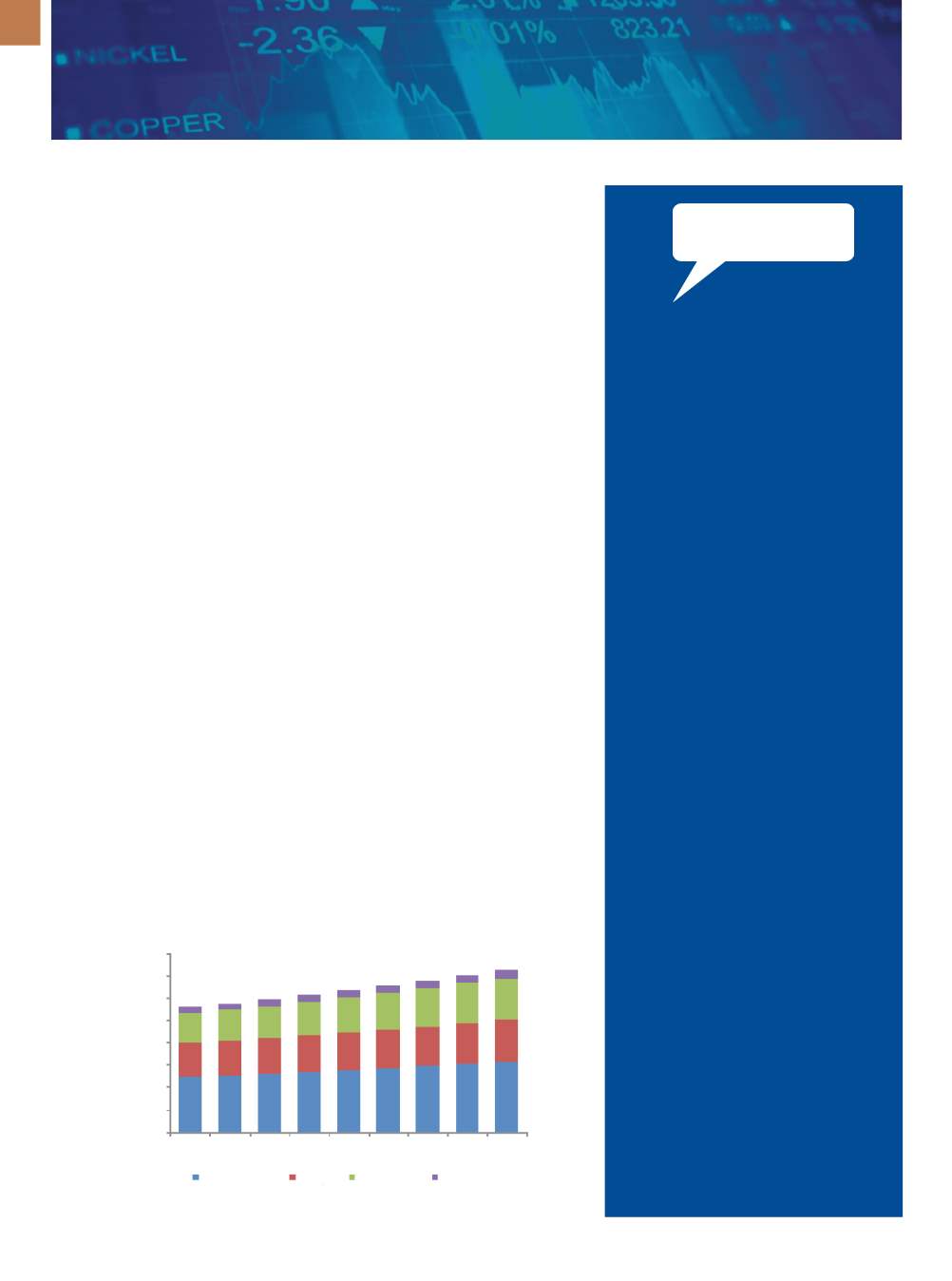

2024,” visit grandviewresearch.com.HighPerformanceAlloysMarketRevenuebyRegion, 2012-2020($Million)

Courtesy of Grand View Research Inc.

1600

1400

1200

1000

800

600

400

200

0

2012 2013 2014 2015 2016 2017 2018 2019 2020

North America Europe Asia Pacific Rest of World