A D V A N C E D M A T E R I A L S & P R O C E S S E S | O C T O B E R 2 0 1 5

6

MARKET SPOTLIGHT

FEEDBACK

NEW REPORT HIGHLIGHTS 3D PRINTING TRENDS

A new report from Stratasys Direct

Manufacturing, Valencia, Calif.,

3D Print-

ing’s Imminent Impact on Manufactur-

ing,

provides an in-depth look at current

and emerging trends in additive man-

ufacturing (AM). The report is based on

an independent survey of 700 design-

ers, engineers, and executives—40%

of whom are employed by companies

with more than $50 million in revenue.

The majority of respondents, represent-

ing aerospace, automotive, consumer

products, and medical devices, say they

strongly believe more end-use parts will

be designed specifically for AM in the

near future. Further, additive metal use

is expected to nearly double over the

next three years.

Participants were asked what they

believe are the greatest benefits of

using AM. The most common responses

include more complex design capabili-

ties (79%), reduced lead time for parts

(76%), and improvements in manu-

facturing efficiency (42%). Respon-

dents were also asked about their

views on in-house production versus

outsourcing. With regard to the top

benefits of outsourcing, the most pop-

ular responses cite access to advanced

equipment and materials (73%), less

investment risk (60%), ability to pro-

duce parts not able to be manufactured

internally (53%), and access to AM

expertise (47%).

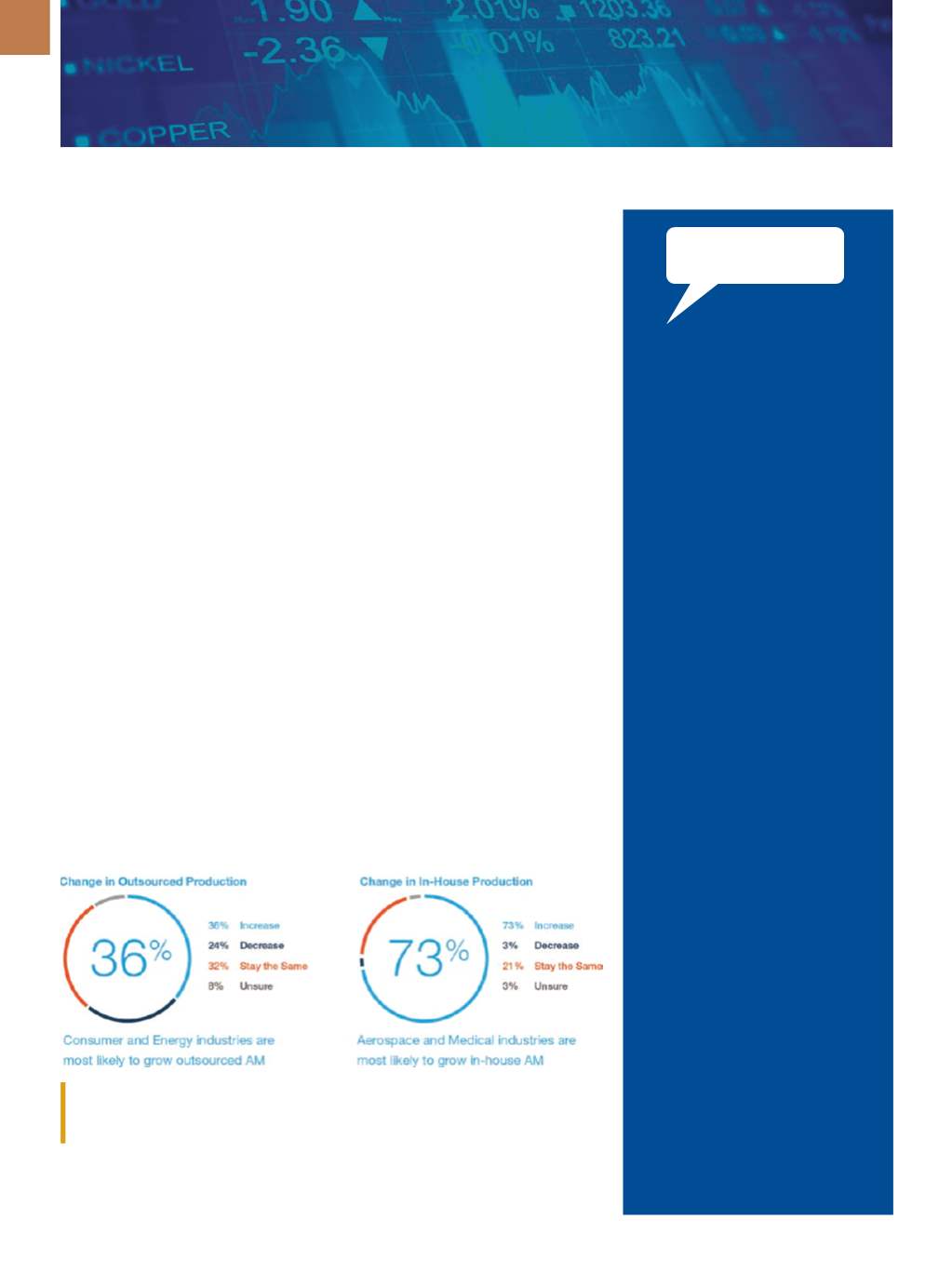

Survey takers were asked to share

their views on the top challenges faced

by their companies with regard to

using AM. Participants cite equipment

costs (63%), limited materials (54%),

post-processing requirements (39%),

and manufacturing costs (38%) as

today’s top concerns. As far as appli-

cations, respondents foresee a 36%

increase in tooling by 2018 and 38%

growth in end-use parts—with aero-

space and automotive expected to see

the largest increase. Participants were

also polled about which materials they

would like to see further developed

for AM: Top responses include metals

(84%), rubber-like materials (61%),

high temperature plastic (60%), and

carbon fiber (52%). To access the full

report, visit

pages.stratasysdirect.com/ trend-forecast.Participants were asked whether they expect their company’s in-house 3D printing produc-

tion to increase, decrease, or stay the same over the next three years, and were asked the

same question relative to outsourcing. Courtesy of Stratasys Direct Manufacturing.

MINIMILL MISTAKES

The recent article “Steel Minimills—

Part 1” (June issue) attributed the

supply of the continuous casting

machine at theNucor-Crawfordsville,

Indiana, facility to Siemens, which

is incorrect. This machine, and all

subsequent machines of this design

throughout the world, have been

furnished by SMS-Siemag AG, now

known as SMS Group. Also, the

second Nucor facility is located at

Hickman, Arkansas, not Iowa.

Bob Garness

MINIMILL MEMORIES

I read with great interest the article

“Steel Minimills: Part II” (July/August

issue). I was a full-time lab technician

at North Star Steel from 1972–75,

and then part-time from 1975–80

through college. By allowing me

to work during school, North Star

essentially financedmy B.S. degree

in metallurgical engineering at the

University of Minnesota and I’ll

always be grateful to them for that.

I was there when they built or pur-

chased a plant in Monroe, Michigan,

and also when they added a car

shredder and an epoxy coating group

for their rebar. Every once in a while,

I drive by the plant and wonder what

happened to North Star and if they

are as big as they used to be. Judging

from your article, I guess not. Thanks

again for the interesting history. It

was a pleasure reading about the

good ol’ days in the steel business.

Steve Nelson

We welcome all comments and

suggestions. Send letters to

frances. richards@asminternational.org.