A

ccording to the new report—

Cobalt: Market Outlook to 2018

—from

Roskill Information Services, London, global cobalt consumption in-

creased at a compound annual growth rate of 5.5% between 2008 and 2013.

Roskill expects future demand to grow at a similar rate, approximately 6.1%

per year to 2018. Demand will be led by Asia, particularly China, South

Korea, and Japan, mainly driven by battery cathode production.

The market went into oversupply in late 2009 and remains in surplus,

say analysts, and supply is expected to continue to outstrip demand both

this year and next. Beyond 2016, demand is forecast to grow at a faster

rate than supply. However, it will take several years for the recent period

of oversupply and stockpiling to reconcile, which is likely to keep prices

in check over the medium term.

Developments in the Democratic Republic of the Congo (DRC), the

world’s largest mine producer, have the potential to significantly impact

the market this year. The DRC government wants to increase domestic re-

fining of copper and cobalt products and decrease exports of unrefined

materials. However, while the proposed export ban on concentrates did

not come to fruition in 2013, government rhetoric suggests that such

measures could still go ahead this year. While a

blanket ban remains unlikely, the 2013 increase in

export taxes, from $60 to $100 per ton, could be

the first of several changes.

Outside of the DRC, a number of potential

mine projects could produce cobalt raw materials,

although many are at an early stage of exploration

or development. Additional mine supply is likely

to come from expansion projects at existing producers through 2018. Fu-

ture demand is expected to grow at

more than 6% annually to 2018, under-

pinned by strong growth in China, the

world’s biggest refined producer. As a

result, demand is expected to reach

more than 110,000 tons annually.

Cobalt use in battery applications

will drive consumption and is

forecast to grow at 9.2% per

year, say analysts.

Prices are expected to con-

tinue a slight downward trend in

2014with the ramping up of new

projects in Madagascar and the

Philippines bringing additional

material into the market and com-

pounding the current oversupply sit-

uation. Thereafter, Roskill expects a

modest year-on-year increase with high-

grade cobalt prices increasing at roughly

3.6%per year to 2018.

Formore information,

visit

www.roskill.co.uk/cobalt.ADVANCED MATERIALS & PROCESSES •

MAY 2014

4

spot l ight

feedback

market

Cobalt market braces for

change in 2014 and beyond

Dream cars

In our March “Feedback” department,

we asked readers about their favorite

automotive memories and aspirations.

Here are a few of our favorite responses:

1960 Sunbeam Alpine Roadster

My first car was a well-used Sunbeam

Alpine Roadster that I bought in Norfolk,

Va., when I was in the Navy. It had a

convertible top, tonneau cover, and re-

movable plastic hardtop. I tried to drive

it to my job interview with Harry Chan-

dler [author of

Metallurgy for the Non-

Metallurgist

] in the fall of ‘69, but it

broke down on the New York State

Thruway. I made it to Materials Park a

couple of days later in my dad’s Ford.

The rest is history. Now I wish I’d had

the wherewithal to have the Sunbeam

restored. It was a nice ride, when it ran.

Don Baxter

My first ‘67 Corvette Sting Ray

was a red, big block 427ci/435hp

that I bought in late 1967 from a

guy who got new ones every fall. I

was working for GE in Schenec-

tady, N.Y., in the Large Steam Tur-

bine Dept. My monthly insurance

payment was more than my loan

and gas costs because the car

was considered a high-powered, two-

seat sports car and I was under 25. My

current ‘67 Sting Ray is a 327ci/350hp

high performance, Goodwood Green con-

vertible with the optional hardtop. 1967

was the last year of the original Sting Rays

(1963-67) and this one is very correct and

very fast from 0 to 80 mph, one power

shift from first to second, and corners well

with a stock/original suspension.

Ron Natole

1956 Continental Mark II

My ideal car is the Continental Mark II,

the last true classic made in the U.S. It

will turn heads anywhere.

Chuck Dohogne

We welcome all comments

and suggestions. Send letters to

frances.richards@asminternational.org.

1967 Corvette Sting Ray

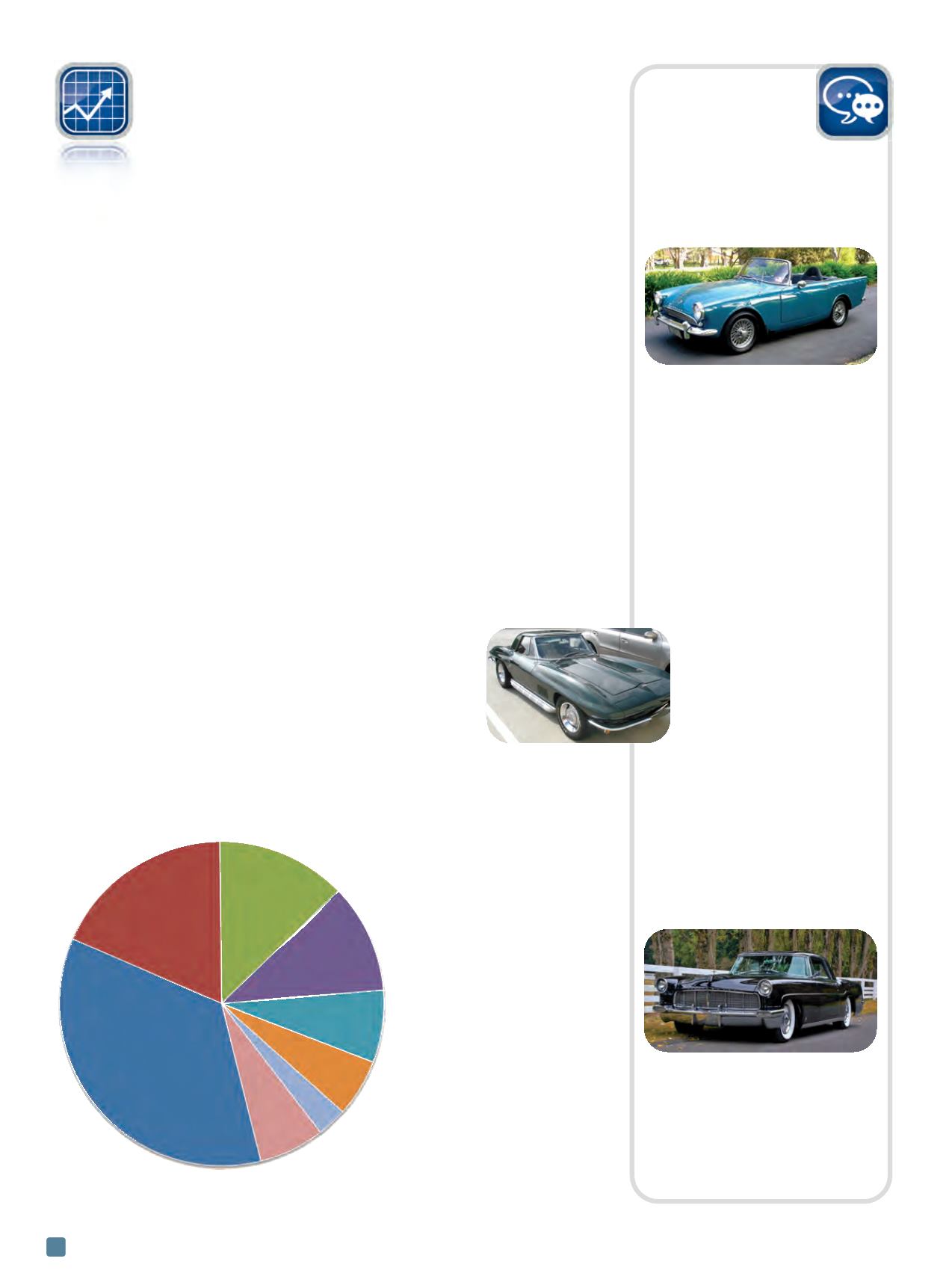

World Consumption of Cobalt,

by end use, 2013

Source: Cobalt Market Outlook to 2018,

Roskill Information Services

Nickel alloys

18%

Batteries

35%

Other

7%

Soaps and

dryers

3%

Magnets

6%

Catalysts

11%

Tool materials

13%

Pigments and

decolorizers

7%