A D V A N C E D M A T E R I A L S & P R O C E S S E S | A P R I L 2 0 1 6

6

MARKET SPOTLIGHT

FEEDBACK

AUTOMOTIVE DEMAND FOR PLATINUM

ON THE RISE

The World Platinum Investment

Council recently announced publica-

tion of its sixth

Platinum Quarterly,

a

free quarterly analysis of the global

platinummarket. The report incorpo-

rates analysis of supply and demand

during the fourth quarter of 2014

and for all of 2015. It also provides a

2016 forecast. The report is based on

research and detailed analysis con-

ducted by SFA (Oxford) Ltd., UK, an

independent authority on the plati-

numgroupmetalsmarket. The global

platinum market ended 2015 in defi-

cit by 380,000 ounces (380 koz), with

key drivers of the shortfall including:

•

2015 saw a 5% increase in auto-

motive demand, reaching

3455 koz, up from 3290 koz in

2014 and 3160 koz in 2013. De-

spite the impact of the Volkswa-

gen diesel investigation, 2015 de-

mand growth was led by Western

Europe vehicle sales growth, up

9% year-on-year, where the impo-

sition of the new Euro 6 legisla-

tion increased platinum loading

per car. Automotive demand from

India also grew by 9%.

•

Industrial demand increased by

4% during 2015, buoyed by a 2%

rise in chemical demand growth

SILVER SPOONS

Thank you for including the very inter-

esting story of Dr. Edgar C. Bain (“Metallurgy

Lane,” January 2016). After reading the article,

I thought I might pass along my recollection

of Dr. Bain. It is brief but indelible. In the fall of

1969, Dr. C.S. Smith was to address a meeting

of the ASM Pittsburgh Chapter. Another young

metallurgical engineer and I were assigned by

the Chapter to deliver Dr. Smith to the meeting

fromDr. Bain’s home in Sewickley, Pennsylva-

nia. By prior arrangement, we two metallurgists

were to arrive at Dr. Bain’s home in the late

afternoon to collect Dr. Smith. Upon our arrival,

Mrs. Bain escorted us to Dr. Bain’s study where

he and Dr. Smith were discussing the future of

scientific discovery, whether it should be based

on atomic considerations of metals andmateri-

als or on biological pursuits.

Mrs. Bain, a wonderful hostess, offered

coffee to us two “coachmen.” Being young and

polite, we accepted. In a short time, the coffee

arrived in fine china cups, with saucers, cream

and sugar, and of course, spoons with which to

serve ourselves. At this point, I recollect Drs. Bain

and Smithmay have been secretly conspiring

to test our metallurgical knowledge. We added

sugar and cream to the coffee and without much

thought commenced to stir the coffee. Immedi-

ately the roomechoed two very distinct clinks—

the sound of spoons dropped and clattering

within the cups, caused by the painful sensation

of heat conducted through the silver spoons

(not likely silver alloy) from the hot coffee to our

youthful, unprepared fingers. Whether or not

this is accurate, I recall both Drs. Bain and Smith

being quietly amused at the lesson on thermal

conduction being given to us that day.

Dr. Bain was a metallurgical giant. I am

proud of having made his personal acquain-

tance that fall day. I wish his demeanor could

guide more young people into our field.

TimKosto

We welcome all comments

and suggestions. Send letters to

frances.richards@asminternational.org.

driven by North America, West-

ern Europe, and China. Greater

global demand for oil refining

and a swing from refinery reduc-

tions to net capacity expansion

saw demand from the petroleum

sector more than doubling—from

65 koz in 2014 to 160 koz in 2015.

•

Jewelry sales contracted by 4%

over the year, affected by a fall

in Chinese demand. In contrast,

demand for platinum in India

surged by 26% on the back of

strong bridal growth and in-

creased sales of men’s jewelry.

•

Refined production grew by

24% over the year, led by a 41%

increase in output from South

Africa, where operations affected

by the 2014 strikes returned to

pre-strike levels and producer

sales again exceeded refined

production.

•

Global supply from recycled plat-

inum fell by 15% over the year

to 1725 koz, as lower platinum

group metals prices reduced

the flow of scrap catalysts from

collectors, while depressed steel

prices reduced the scrapping of

vehicles.

For more information, visit

platinum- investment.com.

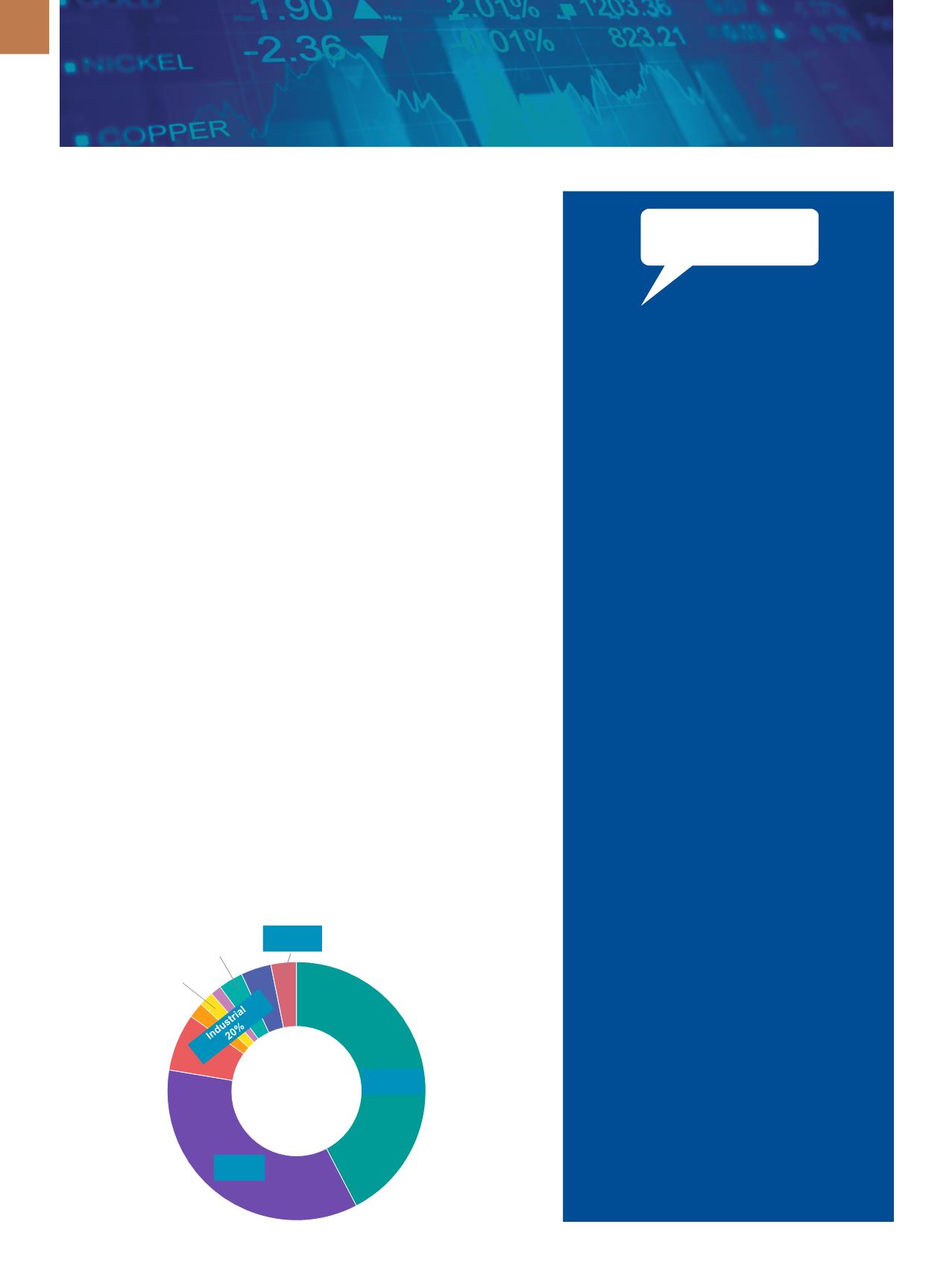

Automotive

42%

Jewelry

35%

Chemical

7%

Petroleum

2%

Electrical

2%

Glass

2%

Medical and

Biomedical

3% Other

4%

Investment

3%

2015

Demand

8205 koz

Source: SFA (Oxford) Ltd.